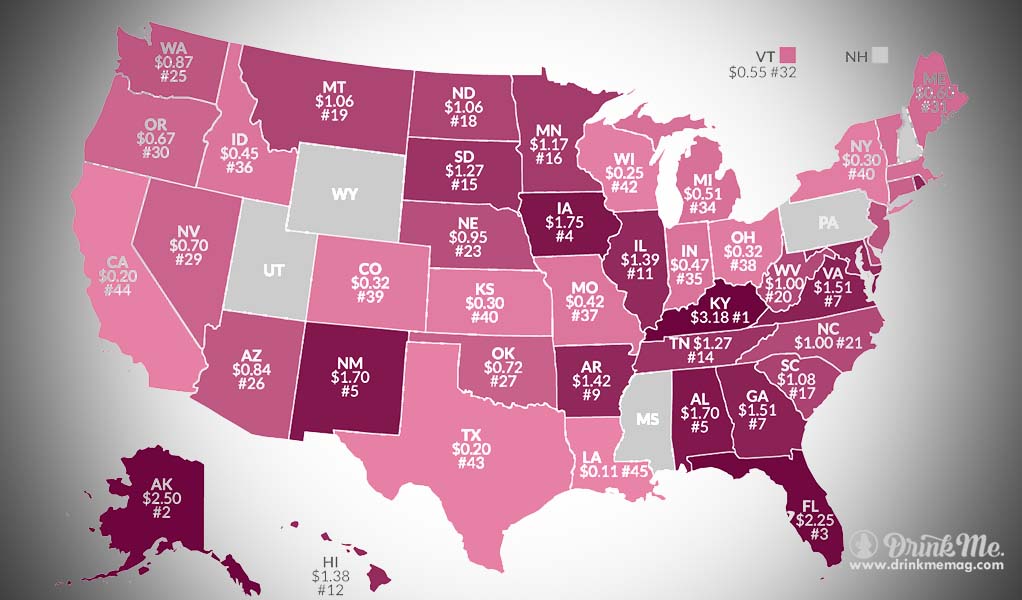

It is no secret that wine is usually taxed at a higher rate than beer because of its higher alcohol content. But even so, taxes vary based on your state. Curious about the discrepancies between each state? Here’s an interactive map published by the Tax Foundation that puts each state on a scale to determine the highest and lowest taxed areas. Fees can be based on case or bottle size as well as sales taxes specific to alcoholic beverages and wholesale tax rates. Varied rates are also attributed to wine type with wines containing a higher alcohol content priced more. Wines with up to 14% alcohol by volume (ABV) are taxed at $1.07 per gallon, while wines with 14-21% ABV are taxed at $1.57 per gallon and wines with 21-24% ABV are taxed at $3.15 per gallon. Sparkling wines are in their own category and at taxed at $3.40 regardless of alcohol content. The states with the highest excise wine taxes per gallon include KY ($3.18), AK ($2.50) and FL ($2.25). And, the states with the lowest excise wine taxes per gallon include LA ($0.11), CA ($0.20) and TX ($0.20). The rankings do not include the states that control all sales: MS, NH, PA, UT, and WY.

Understand how wine is taxed and discover where your state ranks!

Tax Foundation Interactive Wine Tax Map // Facebook //Twitter